Let’s count it down.

Here are February’s five advanced business tips for over-50 entrepreneurs. We start with #5.

Credit: [READ THIS. DO THIS. YOUR SCORE WILL GO UP IN THE NEXT 30 DAYS.]

In order to run a successful business, you’re going to need capital. That means bootstrapping from your savings or borrowing from either a lending institution or personal (friend or family) contact. There is a third option that has to do with Silicon Valley-type investors. But chances are, as a new, unknown startup, this funding source will be out of reach, at least, in the beginning.

In our group, we have long-time financial planning wizards such as Rick Skinner and Alfred White, who know far more than I do on this subject. So, for the purpose of this article, let’s stick to the basic nuts and bolts.

Let’s focus on a traditional lending institution such as a bank, credit union, or financial institution connected to the SBA. No matter the thoroughness of your business plan or uniqueness of your product or service, these lending institutions are going to check your credit. Credit history reflects the manner in which you’ve handled your debt obligations in the past. Roughly 35% of your score is based on past timely payments. Perhaps, even more important, however, in terms of business capital, is your debt ratio. Debt ratio reflects your total debt to total assets (current position), expressed as a percentage.

In other words, what are your “debt” liabilities compared to assets? Are you sitting on liquid assets such as savings, real money in the bank, prepaid contracts, debt-free land and real estate, stocks and bonds, and other tangible assets? Or, are you a human Enron in disguise?

In order to run a successful business, you’re going to need capital. That means bootstrapping from your savings or borrowing from either a lending institution or personal (friend or family) contact. There is a third option that has to do with Silicon Valley-type investors. But chances are, as a new, unknown startup, this funding source will be out of reach, at least, in the beginning.

If you plan to start a business, why wait until your potential lender runs a credit check before you get your credit presentation in order? You have the power to fortify your entrepreneurial journey. Start thinking like an entrepreneur right now.

This is an example of the over-50 entrepreneurial mindset you want to embrace on a daily basis.

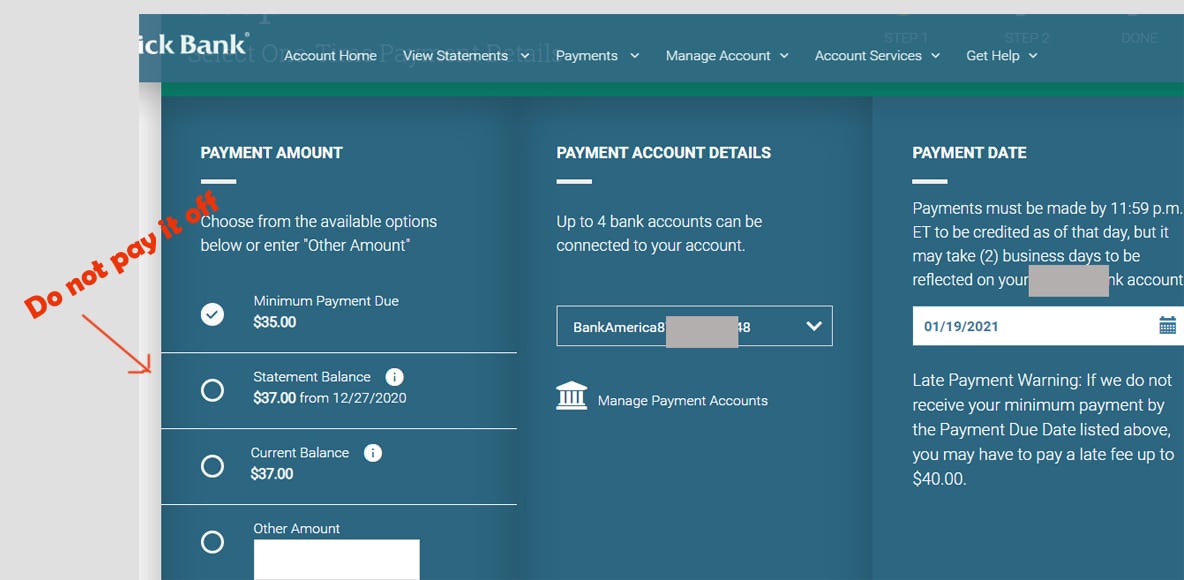

Look at the bank chart captured with this article. This screenshot shows one of my credit card payments in progress. I have paid the $2,000 card down to the balance of $37. Why am I paying the minimum payment of $35? Why not just pay the whole thing off?

You have to understand the sophisticated credit algorithm used by large reporting companies such as TransUnion and Equifax. The algorithm has access to ALL of your credit activity. It calculates your total credit usage, that is to say, the total liquidity or total dollars you have on all of your cards, and how many of those dollars you have already exhausted.

Let’s say you have five credit cards, each with a limit of $1,000. That means you have $5,000 in total spending power. That is an asset. However, if you have already charged up $4,000 of your spending power, it means you only have $1,000 left. You have four times more debt than you do assets. Your credit score is going to tumble. Your banker (potential lender) is going to ask you to leave the building.

Although you’ve been paying your bills, you’re too debt-heavy to get the capital you need to start your business. With my example, I don’t want to EVER pay the credit card balance in its entirety. If I have a zero balance and don’t use the card, the credit card company will eventually close my account. I’m just a deadbeat, taking up space in their system.

If they close my account, the credit algorithm will see that and drop my score because the $2000 spending power (asset) I had when the card was active will vanish. I paid my card on time. But the card is no longer around to bear witness.

An advance move for the over-50 entrepreneur is to pay credit cards down below 20%. But keep ALL credit accounts opened. Buy a greasy burger or pack of gum each month. Keep your spending power intact. On my next statement, the card in this example will show a two-dollar balance, plus a few cents in interest. That is a red flag to me. It means I need to go out and use the card. Otherwise, I’ll pay it off, forget about it because it’s not in my wallet, and in the end, get a notice that my account has been closed. Synchrony Bank is notorious for this. I try not to deal with them at all.

Okay, that’s your February tip #5. Four more are on the way. Please let me know if this was helpful. If you’re not in the Over-50 Entrepreneur group, join today. You’re going to get smarter whether you like it or not!

Thanks a lot for giving everyone an extraordinarily brilliant chance to read articles and blog posts from this business owner blog. Aileen Harris Megen